Updated: March 17, 2025

The Kinder Institute of Life Planning is a globally recognized organization dedicated to transforming financial advisory services through a client-centered approach known as life planning. Founded by George Kinder, the institute trains financial professionals to integrate clients’ personal aspirations into their financial strategies, ensuring their wealth supports a fulfilling and meaningful life.

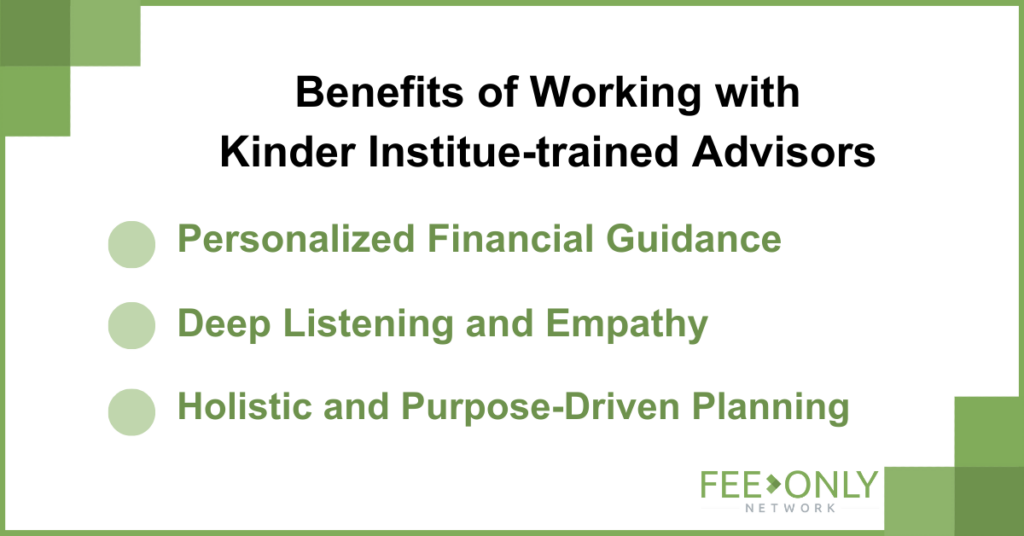

The Kinder Institute aims to shift financial planning from a numbers-driven process to one that prioritizes clients’ values, dreams, and life goals. By helping advisors develop deep listening and empathetic communication skills, the institute fosters stronger client relationships and more impactful financial guidance.

Life planning goes beyond traditional financial advising by emphasizing the human side of wealth management. It encourages financial advisors to explore their clients’ life aspirations first, then craft financial strategies to achieve them. This approach ensures that financial plans align with what truly matters to clients, rather than being dictated solely by investment returns or wealth accumulation.

A core element of the Kinder Institute’s methodology is George Kinder’s Three Questions. These thought-provoking prompts help clients uncover their deepest goals and desires:

By reflecting on these questions, clients gain clarity on their priorities, enabling advisors to create personalized financial plans that genuinely support their ideal lives.

The Kinder Institute developed the EVOKE® process, a structured methodology for implementing life planning effectively. This five-step framework guides financial advisors in helping clients articulate and achieve their life goals:

The Kinder Institute offers training programs leading to the Registered Life Planner® (RLP®) designation, equipping financial professionals with the skills to incorporate life planning into their practice. The RLP® designation signifies an advisor’s expertise in guiding clients through the life planning process, ensuring financial plans are deeply aligned with personal goals.

Life planning transforms financial advising by fostering deeper client relationships and ensuring financial strategies support meaningful life experiences. Instead of focusing solely on wealth accumulation, advisors trained by the Kinder Institute help clients use their resources to lead fulfilling lives, making financial planning a more holistic and impactful profession.

What does The Kinder Institute of Life Planning do?

The Kinder Institute trains financial professionals in life planning, a client-centered approach that integrates personal goals with financial strategies.

How do financial advisors earn the Registered Life Planner® (RLP®) designation?

Advisors earn the RLP® designation by completing specialized training through The Kinder Institute, which teaches the EVOKE® process and life planning principles.

What are George Kinder’s Three Questions?

These questions encourage clients to reflect on their ideal life, helping advisors tailor financial plans to support their most meaningful aspirations.

How does life planning differ from traditional financial planning?

Traditional financial planning focuses on investments and wealth management, while life planning prioritizes aligning financial decisions with personal values and life goals.

Where can I learn more about The Kinder Institute?

For more information, visit The Kinder Institute of Life Planning.

Allan Slider is the Founder of FeeOnlyNetwork.com, a one-of-a-kind digital platform that elevates the visibility of fee-only financial advisors, individually and collectively. Fee-Only advisors are ONLY compensated by the client and NEVER make commission by selling financial products, or receiving kickbacks from brokerage firms. Allan is a consumer & investor advocate and a 20+ year veteran of online marketing for financial advisors.

If you're seeing this message, it's because the web browser you're using to access our site is much older and no longer supported. Due to privacy and safety concerns, we don't allow older browsers to access our site. In order to access WhyFiduciary.com, please use a newer browser, like Internet Explorer 10 or above, Google Chrome, or Mozilla Firefox.

Download a newer browser